Offering and Sales Amounts Total Offering AmountĬlarification of Response (if Necessary): The Total Offering Amount represents the target amount for the Issuer and its State(s) of Solicitation (select all that apply)Ĭheck “All States” or check individual Statesġ3. Minimum Investment Minimum investment accepted from any outside investor Business Combination Transaction Is this offering being made in connection with a business combination transaction, such as a merger, acquisition or exchange offer?ġ1. Security to be Acquired Upon Exercise of Option, Warrant or Other Right to Acquire Securityġ0. Option, Warrant or Other Right to Acquire Another Security Type(s) of Securities Offered (select all that apply) X Duration of Offering Does the Issuer intend this offering to last more than one year?ĩ. Federal Exemption(s) and Exclusion(s) Claimed (select all that apply)Ĩ. Principal Place of Business and Contact Information Name of IssuerĬlarification of Response (if Necessary):Ħ. Jurisdiction of Incorporation/OrganizationĢ. UNITED STATES SECURITIES AND EXCHANGE COMMISSIONġ. The reader should not assume that the information is accurate and complete. Since 1989, the firm has invested over $1.8 billion in 68 platform companies and over 100 add-on acquisitions.ĬIVC’s closing of Fund VI follows its earlier fund, CIVC Partners Fund V LP, which closed in March 2017 with $400 million of total commitments.The Securities and Exchange Commission has not necessarily reviewed the information in this filing and has not determined if it is accurate and complete. Geneser.Ĭhicago-headquartered CIVC invests from $20 million to $100 million in US or Canadian-based service companies that have EBITDA from $5 million to $20 million. “M20 kept everyone focused during the transition to virtual meetings, prepared investors for a third-quarter launch, and did an outstanding job bringing everything to completion in today’s virtual environment,” added Mr. “The M2O team did an outstanding job getting us in front of many high-quality investors prior to COVID-19 events,” said Mr. M2O Private Fund Advisors was CIVC’s placement agent for this fundraise and Kirkland & Ellis provided legal services. “We look forward to a long relationship with all of our limited partners.”

“Being able to have a one and only close fundraise demonstrates a strong endorsement of our team, sourcing strategy, value creation approach and performance,” added Mr.

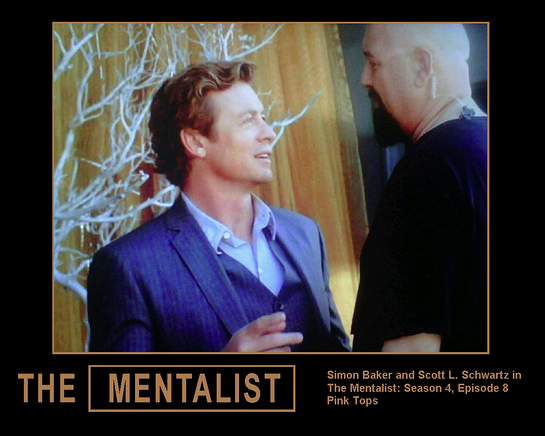

“We are thankful to our existing limited partners who supported a new commitment to Fund VI and all our new investors who valued our strategy and process for creating strong returns.” “We could not have asked for a better way to finish our 50th year in existence than with this successful raise of Fund VI during such challenging times,” said Mr. Today, CIVC is led by partners John Compall, Chris Geneser, Marc McManus, Chris Perry, Doug Potters, Scott Schwartz, and JD Wright. When Continental Illinois was acquired in 1994 by Bank of America, the CIVC team formed a semi-independent private equity firm, CIVC Partners, with backing from Bank of America. The new fund had an original target of $450 million and also closed above its original hard cap.įund VI was backed by both existing and new investors, including insurance companies, fund of funds, pension programs, foundations and endowments, family offices, a sovereign wealth fund, and financial institutions located across the United States and Europe.ĬIVC was founded in 1970 as the Continental Illinois Venture Corporation, a subsidiary of Continental Illinois National Bank. CIVC Partners has closed its sixth fund, CIVC Partners Fund VI LP, with $525 million of limited partner capital commitments.

0 kommentar(er)

0 kommentar(er)